Legislative Update: FICPA hosts CPA Day at the Capitol

February 07, 2025

By FICPA Governmental Affairs

This week, the FICPA hosted more 100 FICPA members in Tallahassee for our annual CPA Day at the Capitol. This year’s event broke all previous records for participation and made a tremendous positive impression around the state Capitol. The FICPA is actively supporting one of the most important legislative initiatives in many years for the profession, so member engagement was more important than ever to help create momentum and tell the positive message of these legislative changes.

CPA Day began with our Leadership Academy graduation and Horizon Awards presentation at the DoubleTree Hotel in downtown Tallahassee. We were honored to be joined by keynote speaker Secretary Melanie Griffin of the Department of Business and Professional Regulation. Joining Secretary Griffin on Wednesday were Deputy Secretary Jared Williams, Executive Director of the Division of Certified Public Accountancy Roger Scarborough, and members of the Board of Accountancy Bill Blend and Steven Plateau. The FICPA thanks the Secretary, Department, and Board for their participation in our CPA Day at the Capitol.

CPA Day at the Capitol was then officially kicked off with a briefing and training session from FICPA Chief External Affairs Officer Jason Harrell, who covered how to effectively communicate with legislators and best advocate on behalf of the profession. Attendees were then assigned into a group by region to align with legislator meetings.

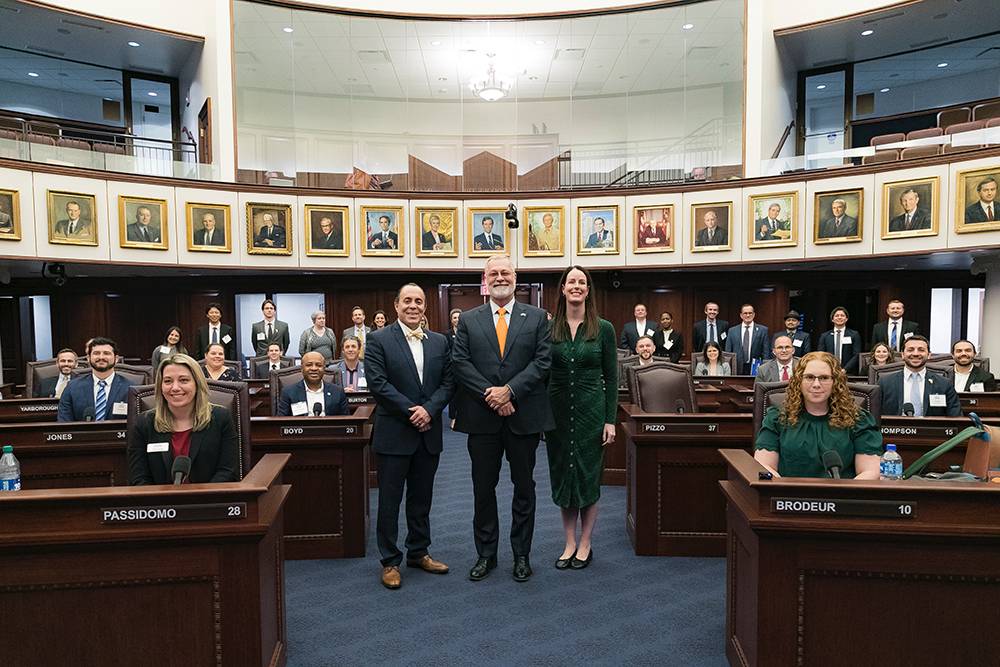

FICPA members then walked to the Historic Capitol for the group photo, before making their way to the Capitol for a full day of meetings and advocacy.

The FICPA strategically scheduled meetings with key legislators who sit on the committees to which our bills have been referred. Together, the FICPA is proud to have facilitated direct meetings with more than 50 legislators. During the event, CPAs either met directly with or delivered materials and contacted all 160 members of the Florida Legislature in the Florida House and Florida Senate.

The day included meetings with key legislative leadership including Speaker of the House Daniel Perez and Senate President Ben Albritton, as well as the chairs and vice chairs of key committees of reference.

The day was also highlighted by a special tour of the Senate Chamber. Members were treated to fantastic overview of the history of the chamber and a very special appearance by Senate President Albritton, who graciously took time to address our membership.

The FICPA is very pleased with the positive feedback and support we received from legislators throughout the day. Thank you to all the members for taking time out of their busy schedules to advocate on behalf of the profession. No one tells your story like you.

FICPA State Tax and SALT leaders meet with DOR

This week, the FICPA also held the annual State Tax-DOR Liaison meeting. The FICPA was represented by both State Tax Committee members and SALT leaders from across the state of Florida.

Executive Director of the Department of Revenue Dr. Jim Zingale and FICPA President and CEO Shelly Weir kicked off the meeting for the group. The agenda included discussions on general tax administration, artificial intelligence tools, technical assistance and a general counsel update.

The FICPA has held this liaison meeting for more 30 years, a testament to our relationship with Department of Revenue. The FICPA Governmental Affairs team wants to thank both the participants from the FICPA and DOR for their engagement during the meeting.

Gov. DeSantis releases FY 25-26 budget proposal

This week, Gov. Ron DeSantis announced his budget proposal for Fiscal Year 2025-2026. The proposed “Focus on Fiscal Responsibility” Budget totals $115.6 billion, with $14.6 billion in reserves. The proposed budget will include $2.2 billion in tax relief, while aiming to reduce the size of government.

Of note, the governor’s proposed budget includes the repeal of the Business Rent Tax. This year, the governor recommends permanently repealing this tax over the next two years, with a one-percent reduction effective Jan. 1, 2026, and another one-percent reduction effective Jan. 1, 2027.

The Governor’s budget proposal was delivered to the Legislature, and the House and Senate will develop their own budget proposals, respectively. Differences between the House and Senate budgets are then resolved in the budget conference process. The budget, or General Appropriations Act (GAA), is the only bill the legislature is constitutionally required to pass during regular Legislative Session.

Legislative Committees continue work after snow, Special Session

Amid all the other events, the legislative process was in full swing. The Florida Legislature was back in Tallahassee this week to continue Interim Committee Weeks after historic winter storms and a Special Session.

As they are a bit behind due to the delays, most of the committees continue to host legislative presentations and have slowly started to take up bills. More bills are being filed every day. Thus far, 478 bills have been filed between the House and Senate. This is fewer than would typically be expected. Each year, there are normally around 2,000 bills filed between the chambers, so it is expected that a significant number of bills will be filed over the next three weeks. The bill filing deadline is March 4, 2025, at noon.

The FICPA will continue to monitor legislative activities for any impact on the CPA profession.

2025 Bill Tracker

Here are some of the key bills of interest the FICPA is monitoring ahead of Session:

Mobility and licensure

House Bill 133 - Public Accountancy by Rep. Caruso / Senate Bill 160 - Public Accountancy by Sen. Gruters. The FICPA’s priority legislation seeks to modernize the CPA licensure for the future by opening new alternative pathways to licensure:

- Current Path: 150 semester hours, one year of experience, and pass the CPA exam.

- New Pathway 1: Master’s degree in accounting/finance, one year of experience, and pass the CPA exam.

- New Pathway 2: Bachelor’s degree in accounting/finance, two years of experience, and pass the CPA exam.

- New Pathway 3: Bachelor’s degree in any field, with coursework in accounting/finance, two years of experience, and pass the CPA exam.

The bill also streamlines practice privileges for out-of-state CPAs who seek to practice in Florida by introducing the concept of automatic mobility. Out-of-state CPAs who hold a license, graduated with at least a bachelor's degree, and passed the CPA licensure exam will be granted practice privileges in the state with no notice and no fee. The bill also streamlines the licensure by endorsement process, creating the most efficient system in the nation.

- HB 133 has been referred to the Industries and Professional Activities Subcommittee in the House of Representatives.

- SB 160 has been referred to the Regulated Industries Committee in the Senate.

House Bill 195 - Education in Correctional Facilities for Licensed Professions by Rep. Chambliss. The bill requires professional boards regulated by DBPR (such as the Board of Accountancy) to ensure that inmates in a correctional institution who take classes that meet the necessary curriculum requirements receive credit toward licensure requirements for the successful completion of classes.

- HB 195 has been referred to the Criminal Justice Subcommittee in the House of Representatives.

Senate Bill 320 - Licensure Requirements for Surveyors and Mappers by Sen. Gaetz. The bill creates alternative pathways to licensure for Surveyors and Mappers. Similarly to the CPA profession, surveyors are licensed and regulated by the Department of Business and Professional Regulation (DBPR). While the bill does not impact the CPA profession, the FICPA will continue to monitor changes in professional and occupational licensure which may impact the profession.

- SB 320 has been referred to Commerce and Tourism in the Senate.

Senate Bill 286 - Mobile Opportunity by Interstate Licensure Endorsement Act by Sen. Rodriguez. The bill impacts licensed medical professionals and their licensure by endorsement process. While the bill does not currently impact the CPA profession, the FICPA is closely monitoring all trends of licensure bills and tracking any that may be amended to include the CPA profession.

- SB 286 has been referred to the Health Policy Committee in the Senate.

Audit/Tax/Industry

Senate Bill 354 – Public Service Commission by Sen. Gaetz. The bill requires a certified public accountant sit on the Public Service Commission.

- SB 354 has been referenced to Regulated Industries in the Senate.

Senate Bill 282 - Home and Service Warranty Association Financial Requirements by Sen. Truenow. The bill makes changes to the regulation of home and service warranty association financial requirements by requiring an association licensed under 634.3077 to meet requirements by providing "one of" the following options, rather than both, the annual audited financial statements and the Form 10-K, Form 10-Q, or Form 20-F.

- SB 282 has been referred to the Banking and Insurance Committee in the Senate.

House Bill 227 - Ad Valorem Taxation by Rep. Caruso/Senate Bill 378 Ad Valorem Taxation by Sen. Harrell. The bill authorizes taxpayers to rescind a previously filed homestead exemption application by notifying the property appraiser using a specified form between August 1 and September 15 of the same tax year. It requires continuous property ownership from January 1 of the previous year until the application date to qualify for rescission and mandates property appraisers to adjust the tax roll to reflect rescinded homestead exemptions before certifying the tax roll to tax collectors. The bill grants the Department of Revenue the authority to adopt emergency rules for managing the rescission of homestead exemptions, effective for 6 months with the possibility of renewal.

- HB 227 is awaiting committee references.

Senate Bill 220 - Social Work Licensure Compact by Sen. Harrell/House Bill 27 – Social Work Licensure Compact by Rep. Hunchofsky. The bill establishes the Social Work Licensure Commission and requires the commission to keep accurate accounts of all receipts and disbursements subject to the financial review and accounting procedures established under its bylaws. All receipts and disbursements of funds handled by the commission are subject to an annual financial review by a certified or licensed public accountant, and the report of the financial review must be included in and become part of the annual report of the commission.

- SB 220 has been referred to the Health Policy Committee in the Senate.

Condos/HOAs

Senate Bill 368 - Community Associations by Rep. Garcia. The bill creates the Condominium and Homeowners’ Association Economic Crime, Fraud, and Corruption Investigation Pilot Program under the Department of Legal Affairs. It gives the Department the power to issue subpoenas and conduct audits for investigations in furtherance of the pilot program and administer oaths, subpoena witnesses, and compel the production of books, papers, or other records relevant to such investigations. If, after reviewing a complaint filed under the pilot program, the department finds sufficient evidence for criminal prosecutions, it must refer the case to the appropriate state attorney for prosecution.

- SB 368 has been referred to Regulated Industries in the Senate.